Are you here because you want to learn to invest in financial instruments like equity derivatives? It is a great way to diversify your financial portfolio. Before getting familiar with what equity derivatives are, let us first get to know what each of the terms means individually.

Equity or equity securities are shares that investors can buy and sell. For example, the purchase of shares of any listed company in the stock market. So, equity represents the shared ownership of a company via stocks and profit sharing.

Now, coming to derivatives. Derivatives are financial instruments that serve as contracts between two or more parties. Derivatives allow you to buy and sell the assets in future. Anticipations and estimations on the future value of the asset help the investors to make gains, on the same basis. The value of derivatives depends on an underlying asset, index, or group of assets.

The combination of these two concepts gives rise to Equity Derivatives. Let’s know how this financial instrument works and what its perks are.

What are Equity Derivatives?

Equity derivatives are an active form of trading on stock exchange platforms. In 2022, the National Stock Exchange (NSE) got recognized as the largest Global Derivatives Market consecutively for the 4th time.

The equity shares that the investor owns can act as an underlying asset, that gives value to the derivatives. Shares, bonds, Commodities, and securities are the kinds of underlying assets. The performance of companies and share market movements affect the value of underlying assets. In much simpler terms, it is the individual stock or leading stock indices like Nifty or Bank Nifty from which it derives its value.

If you prefer to benefit from short-term gains equity derivates are one of the investment options that you can consider. When you buy derivatives you purchase the performance of the underlying securities. It does not mean that you are taking ownership of the company or equity.

Benefits of Trading in Equity Derivatives

Traders invest in equity derivatives for speculating purposes and risk management of their portfolios. They manage the risk through technical and fundamental analysis. To know more about the benefits of trading in equity derivatives, read along.

Risk Management

Equity acts as a tool that converts the risk related to the underlying assets. The risks shift in equity derivatives. Individuals averse to risk become heavy risk-takers in the share market.

Hedging

Investing in equity derivatives helps you reduce the risks that occur due to adverse market fluctuations. It helps investors take an offsetting position.

Arbitrage

Selling of asset in one share market and buying it in the other, to profit from the price difference. You may wonder how the profit is earned. It is because of the difference in the value of assets in different equity derivatives markets.

Margin Trading

In margin trading, you have to pay only a marginal amount. Not the entire amount. Margin trading allows you to maintain high outstanding. When the predictions are accurate, then the profits earned are on the higher side of growth.

Risks Associated with Equity Derivatives

The stock market is the ball game for either risk-averse investors or risk-loving investors, depending on the market conditions. Like any other financial instrument, equity derivatives come with its own share of risks.

Market Risk

Like any other investment, market risk is associated with equity derivatives too. The market can lose value because of dire economic conditions, recessions, and fluctuations in interest rates. This is why, traders need to have extensive knowledge about the market to gauge the potential of an investment.

Volatility

Regular fluctuations in the value of underlying assets result in volatility risks in the market. Due to such fluctuations, the risk of volatility is high in equity derivatives. As these depend on the fluctuations in the stock market.

Counterparty Risk

The counterparty or other parties can become financially incapable of the commitment due to various reasons. Credit risk, litigation risk, settlement risk, etc. come under counterparty risks. These risks arise when the counterparty doesn’t keep their end of the bargain, in the contract.

Who Should Invest in Equity Derivatives?

Traders who consider equity and derivatives as one of smart investing options should invest in equity derivatives. One needs to have an eye for technical detail while making predictions.

Equity derivatives can be a good option for investors who understand the market volatility risk, the overall market risk, and counterparty risk. Investors who are good at risk management, want to diversify their portfolio, and understand hedging against price fluctuations, arbitrage and margin trading can go ahead with investing in equity derivatives.

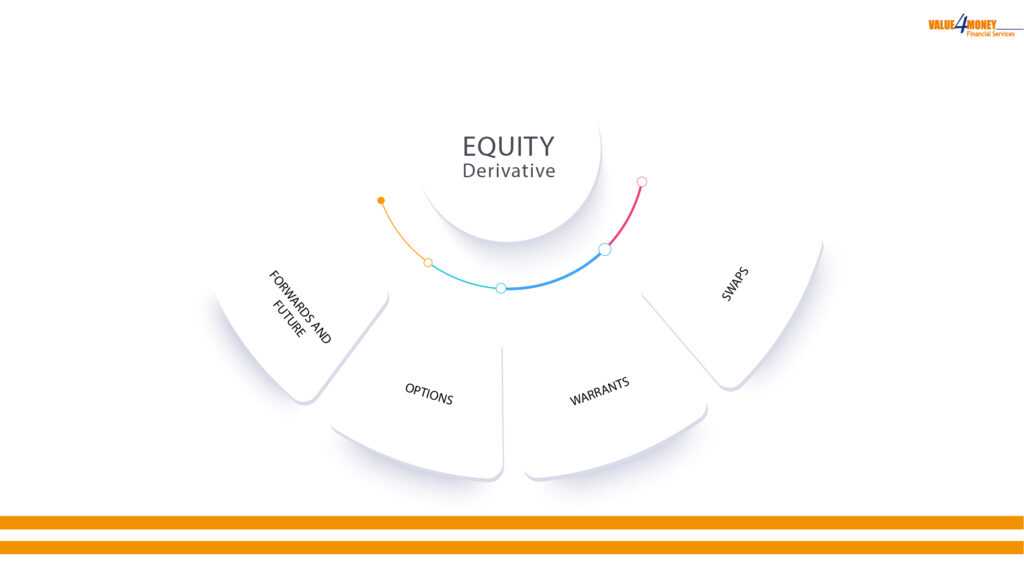

4 Types of Equity Derivatives

Let’s look at the 4 types of derivatives, that allow you to trade through contracts in equity derivatives.

Futures

In equity derivatives, the futures binds the contract between two parties. There is an agreement between the buyer and the seller, where both the buyer and the seller agree to buy and sell the underlying asset at a contract price.

Parties agree on a prespecified date in the future, at a predetermined price to sell the futures contract. The buyer and seller remain obligated to the contract.

Options

Options also allow you to buy and sell the shares at the specified preset prices. This price is called the strike price. It is different from the futures contract in a way that the buyer is not obligated.

Hence, the buyer may or may not hold the terms of the agreement. Whereas, the seller is obliged to sell the shares. The losses are limited, and the gains are high, compared to futures contracts

Warrants

In warrants, the holder can buy the underlying securities in future at a specified date. So, this equity derivative type gives the holder the right to buy, without being obligated to do so. It is a sub-variety of the ‘options’ contract. Warrants are a kind of options contract that has a longer term.

Typically, these are contracts traded over the counter.

Swaps

There is an exchange of equity stocks in this kind of equity derivative, as the name suggests. There is an exchange or a swap of two different equity stocks between two parties. Exchange can be of currencies, fixed interests, floating interests, equity-related returns, etc.

At a specified rate, there is an exchange of cash flow on a future date

FAQ about Equity and Derivatives

What is a focused equity fund?

What is Equity Delivery?

What are sweat equity shares?

What is an equity swap?

How are equity derivatives regulated?

How to trade in equity derivatives?

Connect with us at 9825107677 to open an account and trade in equity derivatives.